Guiding Lights: Long Island’s Historic Lighthouses Long Island, New York, is adorned with a collection of majestic lighthouses that stand as timeless sentinels along its shores. These iconic structures not only serve as beacons of safety for sailors navigating the treacherous waters but also hold…

Exploring Beyond: The Next Frontier in Space Exploration Humanity’s fascination with space has fueled a relentless pursuit of exploration beyond…

Embracing the Digital Nomad Lifestyle: Work from Anywhere, Embrace Everything In an era marked by technological advancements and a shift…

Path to Health and Happiness Long Island, New York, is more than just a picturesque destination; it’s a haven for…

A Culinary Journey in the Long Island Long Island, New York, is not only known for its stunning natural beauty…

Preserving Paradise: Long Island’s Environmental Commitment Long Island, New York, is not…

Opinion

A Culinary Journey in the Long Island Long Island, New York, is…

Lifestyle

Embracing the Digital Nomad Lifestyle: Work from Anywhere, Embrace Everything In an era marked by technological advancements and a shift in work culture, a…

Top Hot Spots in Long Island in 2023 Long Island, a coastal…

Embracing the Rich Tapestry of Long Island Lifestyle Long Island, New York,…

Places

Path to Health and Happiness Long Island, New York, is more than just a picturesque destination; it’s a haven for…

Culture

Celebrating the Cultural Tapestry of Long Island Long Island, New York, is not only blessed with natural beauty but also enriched by a diverse and vibrant…

Editor's Picks

Path to Health and Happiness Long Island, New York, is more than…

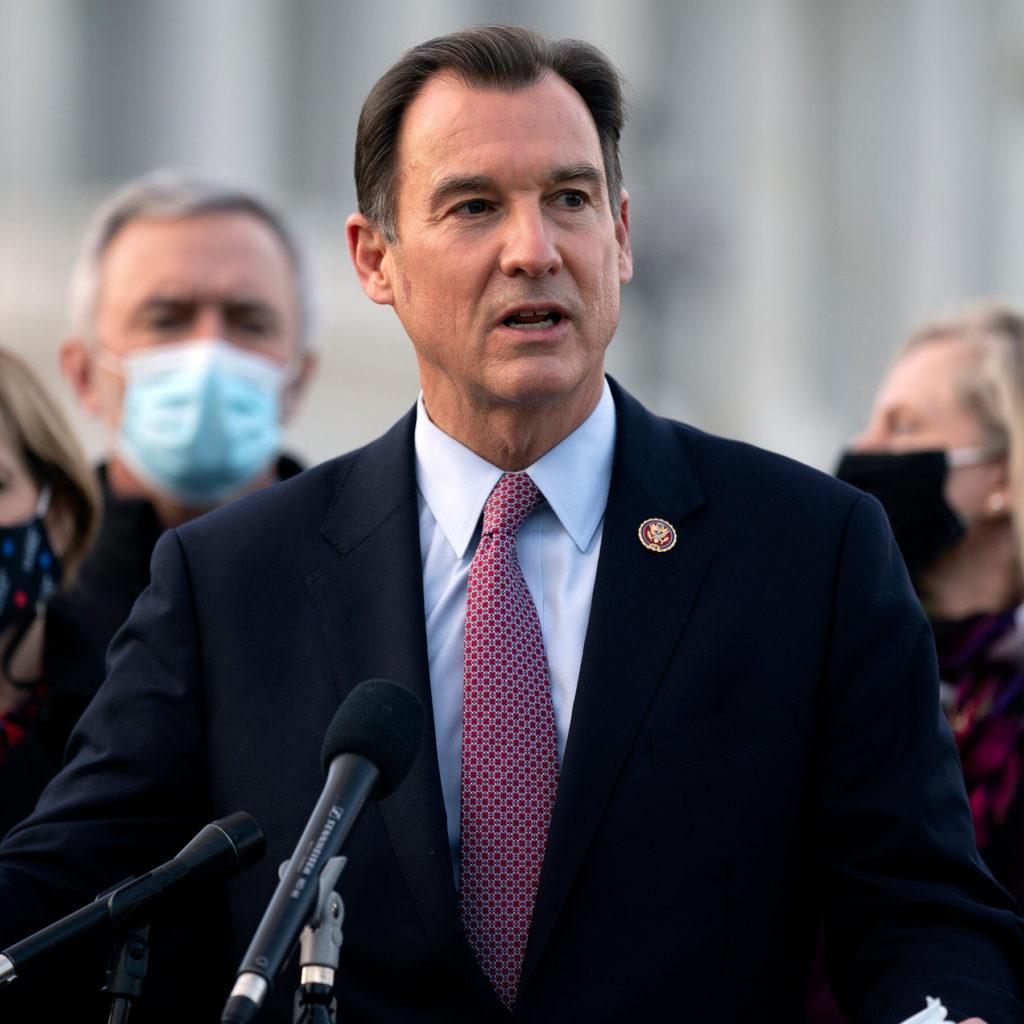

Congressman Suozzi Hosts Convention on Long Island Offshore Wind Supply Chain As…

Technology

Exploring Beyond: The Next Frontier in Space Exploration Humanity’s fascination with space…

Health

Path to Health and Happiness Long Island, New York, is more than…

Politics

Congressman Suozzi Hosts Convention on Long Island Offshore Wind Supply Chain As…